-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Trading indicators are widely used by gold traders to derive insights from historical data so that they could make predictions about gold price movements. Hence, here are the best trading indicators you need to know to successfully trade gold.

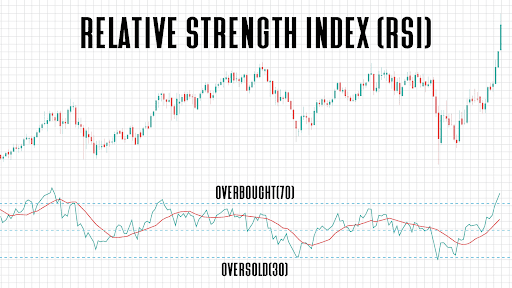

The Relative Strength Index (RSI) indicator measures short-term asset price fluctuations and is used to determine when it would be a good time to buy or sell an asset. In gold trading, the most favourable situation would be when RSI stays above 30 and hits 70 occasionally. A RSI level that falls below 30 generates buy signals as it suggests that the gold asset is being oversold. On the contrary, if the RSI level rises above 70, it suggests that the asset is being overbought and generates sell signals.

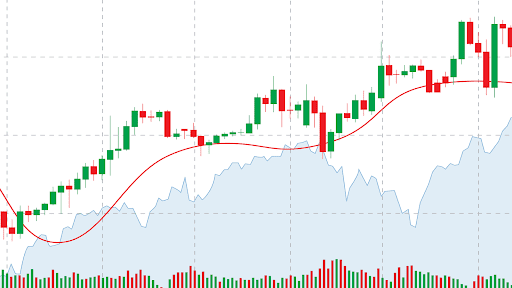

Moving averages (MA) can be calculated by dividing a range of prices by the number of periods happening in the selected range. The moving averages (MA) trading indicator helps gold traders to understand whether the gold asset prices are following an uptrend or downtrend, so that they could make decisions to sell or buy more assets.

There are two types of MA trading indicators; the exponential moving averages (EMA) and the simple moving averages (SMA) indicators. A trader can determine the better MA indicator to use based on their own trading objectives and preferences. EMA focuses more on the recent asset prices whereas SMA assigns equal weighing to all price values. The moving averages indicator can be seen as the red curved line in the image below.

You may also want to read more about Moving Averages here.

Wondering How You Can Invest Or Trade Gold?

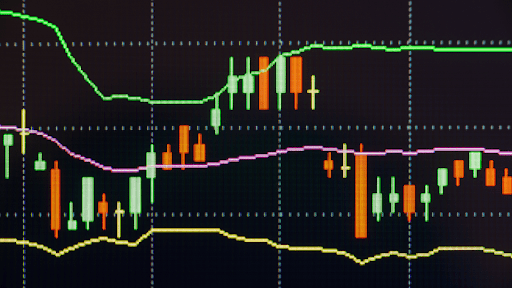

The Bollinger Bands indicator refers to a pair of trend lines used in conjunction with the moving averages indicator to indicate the standard deviation of asset prices from time to time. By using this trading indicator in their technical analysis, gold traders can gain a sense of whether gold prices are high or low on a relative and how volatile the asset market is. The upper band of bollinger bands can be seen as the green line whereas the lower band can be seen as the yellow line in the image below.

Because prices tend to bounce off the upper and lower bounds of the Bollinger Bands, gold traders use them to determine entry and exit points of gold trades. Prices hitting the upper bollinger band is signalling that the asset may be overbought, while prices hitting the lower bollinger band gives a buy signal as it means that the asset may be oversold. Gold traders usually open or close gold trades when its prices hit either one of the Bollinger bands.

It is definitely easier to plan your next steps in gold trading with the help of trading indicators when doing technical analysis. For beginner gold traders that find technical analysis hard to do, they can consider getting started with a demo account to get themselves familiar with gold trading and the platform. Try out PU Prime’s demo account and master the concept of trading gold today.

Want To Get Started With Gold Trading?

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.