-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

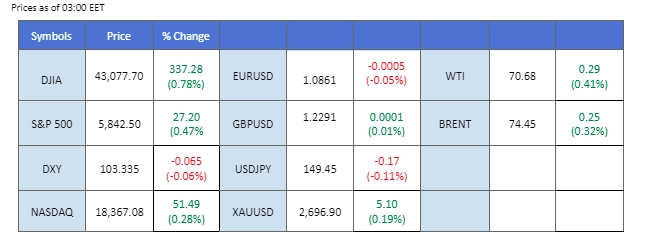

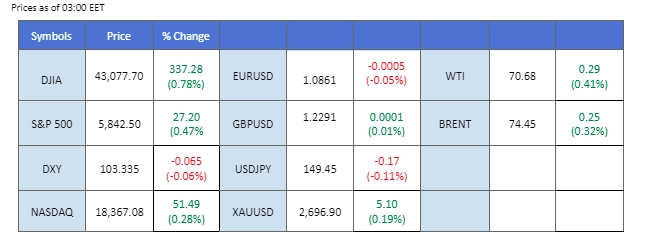

Market Summary

The Dow Jones continues its upward momentum, reaching a new all-time high as the market enters the 3rd quarter earnings season. Strong performances from mega-cap banks such as Goldman Sachs, Morgan Stanley, and Bank of America, which exceeded earnings expectations, have further fueled risk appetite in the U.S. equity market. This optimism has also spilled over into Chinese markets, with a positive reaction in the Thursday morning session as investors anticipate the upcoming press conference by Chinese authorities focused on stabilising the struggling property sector and announcing economic stimulus measures.

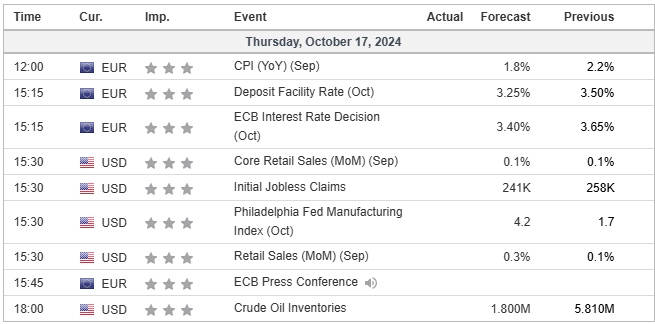

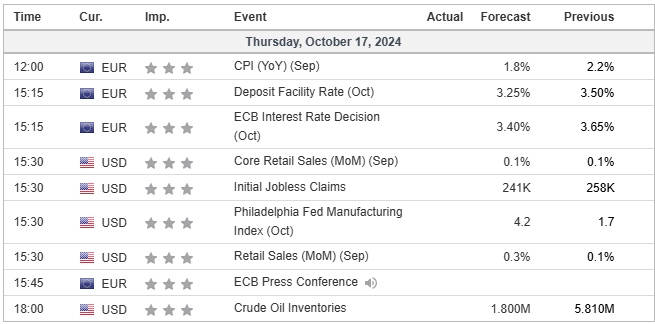

In the forex market, the U.S. dollar index (DXY) has climbed more than 3% in October, supported by robust U.S. economic data. Traders are now eyeing the release of the Initial Jobless Claims report, which is expected to provide further insights into the strength of the U.S. dollar. Meanwhile, the ECB’s interest rate decision, due today, is highly anticipated as it could significantly influence the euro’s direction.

In the commodity market, gold remains strong, driven by heightened geopolitical risks in the Middle East and the South China Sea. The precious metal is now close to its all-time high of $2,685.50, benefiting from its safe-haven status. Oil prices have traded sideways, easing from their bearish trend, but any escalation in geopolitical tensions could lead to a renewed rally in oil prices.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (7%) VS -25 bps (93%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The U.S. dollar firmed on Wednesday, reaching an 11-week high. This strength is attributed to investors ruling out a large interest rate cut from the Federal Reserve at its next policy meeting, coupled with expectations of a potential election victory for former President Donald Trump. Trump’s proposed policies, such as tax cuts, looser financial regulations, and higher tariffs, are seen as dollar positive. Higher tariffs may negatively impact Asian and European exporters, potentially leading their central banks to cut interest rates, thereby weakening their currencies and supporting the dollar.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the index might enter overbought territory.

Resistance level: 103.95, 104.95

Support level: 103.25, 102.50

Gold advanced toward record highs on Wednesday, supported by falling U.S. bond yields and expectations for further rate cuts by major central banks. The drop in U.S. Treasury yields, which reached a one-week low, bolstered gold’s appeal, as the metal generally performs well in a low-interest rate environment. Additionally, geopolitical tensions continue to provide safe-haven demand for gold.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 64, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2690.00, 2705.00

Support level: 2670.00, 2645.00

Pound Sterling fell sharply following a downbeat inflation report. The UK Consumer Price Index (CPI) dropped to 1.7%, below market expectations of 1.9%, marking a decline from the previous 2.2%. This decline is partly due to slower growth in UK wages, with Average Earnings Excluding Bonuses rising by 4.9%, down from 5.1% in the prior period. The weaker-than-expected inflation data and slow economic performance weighed on the Pound’s appeal.

GBP/USD is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bullish momentum, while RSI is at 35, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 1.3040, 1.3205

Support level: 1.2940, 1.2815

The EUR/USD continues to decline as traders anticipate the ECB’s interest rate decision, which is set to be announced today. Recent underwhelming eurozone economic data has increased speculation of a dovish monetary approach from the ECB, putting pressure on the euro. On the other hand, the U.S. dollar remains strong, bolstered by expectations of a more hawkish stance from the Federal Reserve. This outlook has been supported by recent robust U.S. job data, which strengthens the case for the Fed to maintain or even tighten its monetary policy, further boosting the dollar against the euro.

EUR/USD has declined to its 10-week low, suggesting a bearish bias for the pair. The RSI remains low, while the MACD is kept below the zero line, suggesting the pair remains trading with strong bearish momentum.

Resistance level: 1.0890, 1.0950

Support level: 1.08050, 1.0740

The AUD/USD pair rose by nearly 0.5% following the release of the Australian job data during the Sydney session. The unemployment rate dropped to 4.1%, and the employment change showed significant improvement. This robust data suggests that the Reserve Bank of Australia (RBA) may maintain its current monetary tightening policy, focusing on controlling inflation within the economy. The positive job data signals a resilient labour market, which could support the Aussie dollar’s strength. However, despite the recent rise, the pair has yet to break above the 0.6710 resistance level, meaning a bearish structural break has not occurred.

AUD/USD remains trading in a bearish manner, but the MACD has formed a bullish divergence, shall the RSI is able to break above the 50 level and the pair is able to maintain at above 0.6710 mark, this may be a trend reversal signal for the pair.

Resistance level: 0.6730, 0.6780

Support level: 0.6670, 0.6610

The USD/JPY pair has been trading in an uptrend after breaking above its downtrend channel, forming a higher-high price pattern at the recent peak, which indicates the pair is maintaining its bullish momentum. This suggests continued strength in the pair, driven by the robust U.S. dollar. However, traders are advised to keep a close eye on two key economic reports that could influence the pair’s direction. The U.S. Retail Sales data is set to be released today, which could affect the dollar’s strength, while Japan’s National CPI report, due tomorrow, will offer insights into inflationary pressures in Japan.

The pair has gained more than 7% since its recent low in September and is approaching its critical zone at the 150.00 mark, suggesting a bullish bias. The RSI remains at above 50, while the MACD is edging lower, suggesting the bullish momentum is easing with the pair.

Resistance level: 150.85, 152.25

Support level: 147.30, 145.85

Hong Kong’s Hang Seng Index (HSI) has declined by over 10% from its recent peak, driven by profit-taking sentiment and geopolitical tensions, which have dampened risk appetite in the market. The uncertainty surrounding global events has contributed to a cautious tone among investors. However, a potential technical rebound could be on the horizon, as the Chinese authorities are expected to announce a new round of measures, particularly aimed at supporting the troubled property sector. Additionally, improved sentiment on Wall Street may also provide a positive spillover effect, boosting the HSI’s chances for recovery in the near term.

The HSI is approaching its critical zone at near 20100. A break below this mark will be considered a bearish signal for the index. The RSI has declined to near the 50 level, while the MACD is edging lower, suggesting that the bullish momentum is easing.

Resistance level: 21260.00, 22220.00

Support level: 19810.00, 19135.00

Oil prices rose in early Asian trade on Thursday, recovering some of the sharp losses from the previous two sessions. This rebound followed industry data showing an unexpected decline in U.S. crude stockpiles, which fell by 1.58 million barrels in the week ending October 11. Gasoline and distillate inventories also saw substantial declines of 5.93 million and 2.67 million barrels, respectively. Despite these gains, oil benchmarks remain down 6-7% for the week, with ongoing concerns stemming from OPEC and IEA recent demand forecast cuts for 2024 and 2025.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 40, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 72.55, 74.75

Support level: 69.85, 67.10

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.