-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

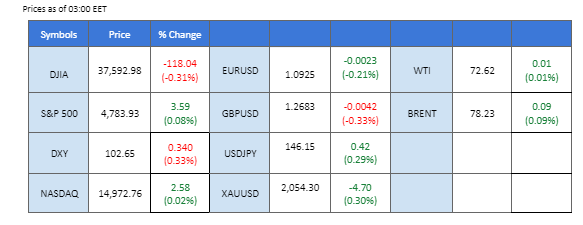

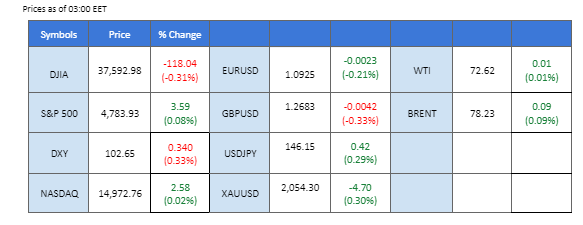

The U.S. dollar has experienced a resurgence, reaching its highest level in a month, propelled by a revival in U.S. treasury yields. This rebound signals a departure from earlier speculation that the Federal Reserve might postpone its anticipated rate cut, as recent job and inflation data underline persistent inflationary pressures in the U.S. In the realm of commodities, oil prices have stabilised as market attention intensifies on the evolving tensions in the Red Sea, a region responsible for supplying a significant portion of the world’s crude oil. Traders are closely monitoring geopolitical developments that may impact oil prices. Furthermore, anticipation looms over Chinese GDP data scheduled for release tomorrow (January 17, 2024). The outcome will likely influence not only oil prices but also the performance of Chinese proxy currencies, including the Australian dollar and the New Zealand dollar.

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

(MT4 System Time)

Source: MQL5

The Dollar Index exhibited a flat performance as US public holidays created a cautious mood in the market. The overall trajectory of the US Dollar remains uncertain, with mixed catalysts contributing to the hesitancy among investors. While expectations of Federal Reserve interest rate easing in March persist, scepticism lingers due to recent positive economic data conflicting with the bearish Dollar view. Investors are eagerly awaiting upcoming economic indicators, including US Retail Sales data and Federal Reserve statements, for clearer trading signals.

The Dollar Index is trading higher following the prior breakout above the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 66, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 102.60, 103.45

Support level: 101.90, 101.30

Safe-haven gold extended its bullish momentum, fueled by escalating geopolitical tensions in the Red Sea. Yemen’s Houthi movement declared an expansion of its targets in the region, including US ships, following strikes by the US and Britain on Houthi sites in Yemen. This development, coupled with the vow to sustain attacks, heightened demand for gold as a safe-haven asset.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 56, suggesting the commodity might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 2055.00, 2075.00

Support level: 2035.00, 2015.00

The Pound Sterling faced headwinds against a resurgent U.S. dollar, bolstered by recent positive economic indicators. Robust job data signals a tight U.S. labour market. At the same time, the latest Consumer Price Index (CPI) reading suggests a potential road ahead fraught with challenges for U.S. authorities to achieve their targeted 2% inflation rate. In the upcoming sessions, the market focus turns to the UK’s CPI reading scheduled for release tomorrow, which is expected to influence the strength of the Pound Sterling.

GBP/USD has retraced sharply from its highest level in 2021 and failed to defend above its support level at 1.2729. The RSI has declined to near the oversold zone while the MACD has broken below the zero line, suggesting the bullish momentum has drastically eased.

Resistance level: 1.2729, 1.2815

Support level: 1.2630, 1.2528

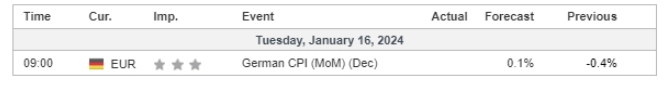

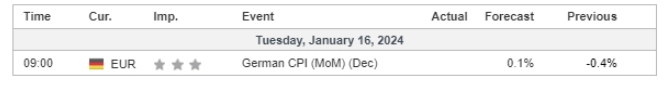

The EUR/USD pair has experienced a notable downturn, breaching its critical uptrend support level and signalling a prevailing bearish sentiment. The primary driver behind this shift has been the recent resurgence of the U.S. dollar, supported by positive economic indicators. The market sentiment regarding an imminent rate cut has subsided, particularly in the wake of a U.S. Consumer Price Index (CPI) reading that indicated signs of rebound. Traders are now turning their attention to tomorrow’s Eurozone CPI reading, with expectations that it will provide insights into the euro’s strength.

EUR/USD’s volatility has been low and has broken below the uptrend support line, suggesting a bearish bias for the pair. The MACD has been hovering closely to the zero line while the RSI has been flowing at the lower region, suggesting the momentum has been low.

Resistance level: 1.0954, 1.1041

Support level: 1.0866, 1.0775

The USD/JPY pair has exhibited an upward trajectory, indicative of the Japanese Yen’s relative weakness against the U.S. dollar. This movement reflects a convergence in the monetary policy outlook of the two nations. Upbeat economic data from the United States has dampened expectations of an imminent rate cut by the Federal Reserve. Simultaneously, the market anticipates the Bank of Japan (BoJ) to delay its shift away from an ultra-loose monetary policy.

USD/JPY continue to trade in an uptrend trajectory, suggesting a bullish bias for the pair. The RSI has been hovering close to the overbought zone while the MACD has been moving lower, giving a neutral signal for the pair.

Resistance level: 146.88, 148.77

Support level: 145.35, 143.80

The AUD/USD pair has exited its consolidation zone, indicating a prevailing bearish sentiment. This shift is primarily attributed to the robust U.S. dollar, strengthened by positive economic indicators. The impending release of Chinese GDP data is poised to influence the Australian dollar, serving as a key determinant for the pair’s future trajectory.

The AUD/USD has dropped out of the price consolidation range, suggesting a bearish bias for the pair. The RSI has dropped to the oversold zone while the MACD has been declining, suggesting the bearish momentum is strong.

Resistance level: 0.6710, 0.6800

Support level: 0.6510, 0.6400

US equity markets were closed on Monday for a federal holiday, setting the stage for potential moves later in the week. Major financial results, including earnings reports from leading banks such as Goldman Sachs and Morgan Stanley, are anticipated. Investors await these reports along with a keen eye on economic data releases, including US Retail Sales and Initial Jobless Claims, for valuable trading insights.”

The Dow is trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 54, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 37850.00, 39275.00

Support level: 36735.00, 35950.00

Oil prices found themselves in a consolidation phase around key resistance levels as conflicting fundamentals clouded the outlook. The avoidance of the Red Sea by tanker owners after strikes on Houthi targets added a bullish element, while a pessimistic economic outlook, particularly challenges faced by China in its economic recovery, tempered gains in the oil market.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bearish momentum, while RSI near the midline, indicating that the oil market might continue to consolidate in a range.

Resistance level: 74.00, 78.65

Support level: 70.25, 67.40

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.