-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

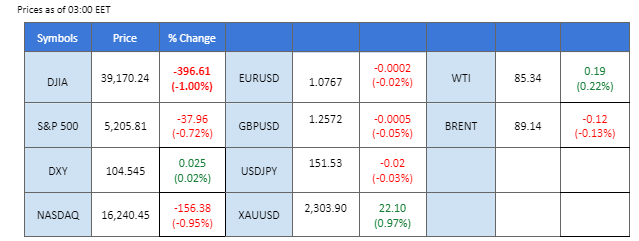

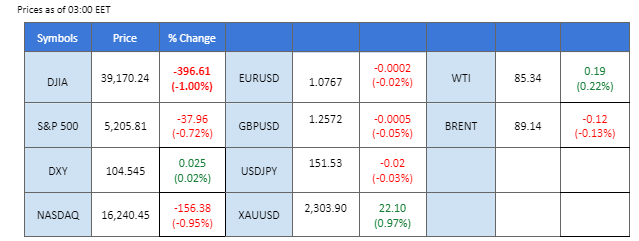

The U.S. stock market experienced a significant decline yesterday, with all three major indexes dropping by approximately 1%. This downturn occurred as U.S. long-term Treasury yields surged to their highest level since last December, fueled by robust economic data suggesting that the Federal Reserve might postpone interest rate cuts. However, the dollar index (DXY) experienced a technical retracement after the release of slightly lower-than-expected JOLTs opening job data yesterday. Market focus now shifts to Jerome Powell’s scheduled speech later today, which is expected to provide insight into the future direction of the dollar.

Current rate hike bets on 1st May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (85.5%) VS -25 bps (14.5%)

(MT4 System Time)

Source: MQL5

The Dollar Index dipped marginally following the release of a disappointing jobs report, with US JOLTs Jobs Opening figures falling slightly short of market expectations at 8.756 million compared to the anticipated 8.760 million. Nevertheless, the dollar’s long-term outlook remains bullish, underpinned by strengthening US Treasury yields and expectations of a prolonged period of high interest rates by the Federal Reserve.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 57, suggesting the index might extend its losses toward support level since the RSI retreated sharply from overbought territory.

Resistance level: 104.95, 105.40

Support level:104.60, 104.00

Gold prices continued to climb amidst weak risk appetite, driven by ongoing geopolitical tensions and anticipation of market volatility surrounding the US elections. Despite the surge in US Treasury yields, gold remained appealing to investors seeking safe-haven assets. However, concerns persist regarding the potential impact of a high interest rate environment from the Federal Reserve on gold’s gains.

Gold prices are trading higher following the prior breakout above the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 72, suggesting the commodity might enter overbought territory.

Resistance level: 2295.00, 2305.00

Support level: 2280.00, 2265.00

Yesterday, the Pound Sterling experienced a technical rebound against the U.S. dollar, spurred by the latest U.S. job data, which slightly underperformed expectations. Despite this rebound, the Sterling’s gains remain tempered. Heightened market speculation that the Federal Reserve may postpone its anticipated rate cuts has maintained a bullish trajectory for the dollar, exerting continuous pressure on the Sterling, which has struggled to find its footing.

GBP/USD remains on a bearish trajectory despite recording a technical rebound yesterday. The RSI remains in the lower region, while the MACD continues to flow below the zero line, suggesting that the bearish momentum is overwhelming.

Resistance level: 1.2660, 1.2760

Support level: 1.2540, 1.2440

Yesterday, the EUR/USD pair experienced a technical rebound, but it failed to reclaim its previous highs, indicating that the bearish sentiment persists. Market sentiment has adjusted in response to recent U.S. economic data, which underscore the country’s robust economic performance. This data has led to speculation that the Federal Reserve may postpone any interest rate cuts, thereby bolstering the dollar. Moreover, attention is now focused on the forthcoming release of Eurozone CPI data later today, which could be a critical determinant of the pair’s future movement.

EUR/USD rebounded but remained below its next resistance level at 1.0775, suggesting the bearish bias remained intact. The MACD flowing below the zero line while the RSI hovering at below 50 level suggests the pair remain trading with bearish momentum.

Resistance level: 1.0775, 1.0866

Support level: 1.0700, 1.0630

The Australian dollar made a significant recovery, offsetting much of the losses experienced in the previous session. This rebound followed a period of weakness prompted by the Reserve Bank of Australia’s (RBA) dovish stance, which had initially applied downward pressure on the Aussie dollar. Despite the U.S. dollar maintaining its bullish momentum, traders are now turning their attention to Australia’s Retail Sales data, set to be released tomorrow. This upcoming economic indicator is anticipated to provide valuable insights into the Australian dollar’s strength and potential future movements.

AUD/USD rebounded from its support level at 0.6485 but has yet to reach its previous high level. The RSI remains below 50, while the MACD flows closely below the zero line, suggesting the pair remains trading with bearish momentum.

Resistance level: 0.6535, 0.6585

Support level: 0.6485, 0.6410

Diminishing expectations for rate cuts contributed to climbing US Treasury yields, resulting in losses across the US equity market. Tesla’s stock plummeted by over 5% after the electric vehicle manufacturer reported disappointing first-quarter delivery numbers, exacerbating the downward trend in the market. The Dow Jones Industrial Average, S&P 500, and NASDAQ Composite all registered declines in response.

Dow Jones is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 39855.00, 40995.00

Support level: 39150.00, 37700.00

Crude oil prices extended their gains following a bullish inventory report from the American Petroleum Institute (API), which showed a larger-than-expected decline in US crude stockpiles. The drop of about 2.3 million barrels contrasted sharply with market expectations of a decrease of approximately 2 million barrels, bolstering optimism for tighter supply conditions and increased demand. Investors await further insights from the Energy Information Administration (EIA) crude oil inventory data for additional market cues.

Oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 74, suggesting the commodity might enter overbought territory.

Resistance level: 85.45, 89.10

Support level: 83.15, 80.20

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.