PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Hold The Global Markets In Your Hands

Our trading mobile app is compatible with most smart devices. Download the App now and start trading with PU Prime on any device, anytime and anywhere.

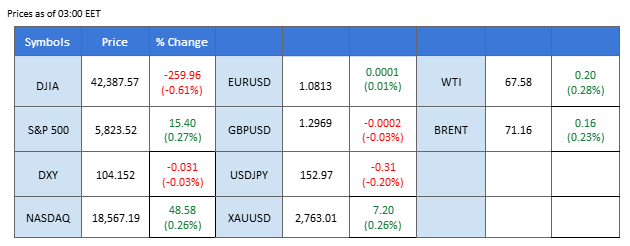

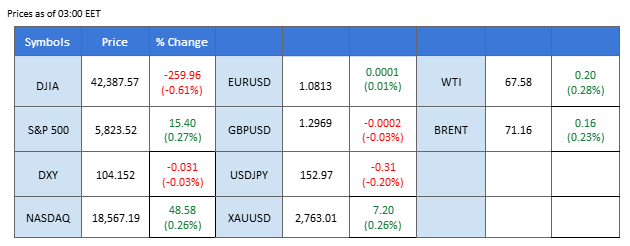

Market Summary

As the U.S. election draws near, safe-haven assets are gaining traction, with gold rallying back to its all-time highs and the U.S. dollar hovering close to recent peaks. Historical trends indicate that the Japanese yen tends to attract strong safe-haven demand during election years, having outperformed the dollar, Swiss franc, gold, and U.S. Treasuries in prior election cycles. With this track record, traders may anticipate a yen rally as November 5 approaches.

On the Australian dollar, attention will turn to the Australian CPI report due tomorrow, which is expected to indicate continued easing in inflation. An in-line reading could further weigh on the already soft Aussie dollar.

In the oil market, prices, which are at monthly lows, may find near-term support with the U.S. planning to refill its strategic reserves—a move that could lend support to oil prices.

Meanwhile, the crypto market has shown notable bullish momentum, with Bitcoin (BTC) crossing the $70,000 mark for the first time since June, nearing its all-time high of $73,000. This surge comes as market sentiment shifts, with Donald Trump, who is viewed as crypto-friendly, appearing to have increased chances of an election win, according to recent data.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (7%) VS -25 bps (97%)

(MT4 System Time)

N/A

Source: MQL5

Market Movements

Market Movements

DOLLAR_INDX, H4

The Dollar Index held steady last week, continuing a positive trajectory as investors evaluated strong US economic data while awaiting key data releases this week. The dollar’s bullish trend has been primarily supported by a 40-basis-point rise in the 10-year Treasury yield for October, with the dollar climbing 3.60%—marking its sharpest monthly increase since April 2022. However, as the US presidential election and the Federal Reserve’s November policy meeting draw closer, market volatility may persist. Investors are advised to monitor these developments and upcoming reports on US Nonfarm Payrolls and unemployment, as these figures could significantly impact the dollar’s movement.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 65, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 104.95, 105.55

Support level: 103.95, 103.45

Gold prices continue a bullish path amid geopolitical tensions and looming global uncertainties. Investor sentiment has been bolstered by the approaching US election, alongside upcoming economic data releases, including US Nonfarm Payrolls, Core PCE Price Index, and GDP figures. Meanwhile, uncertainty surrounding Japan’s economic direction post-election is also pushing demand for safe-haven assets. Investors should remain vigilant about these events, as they are likely to drive heightened volatility and sustained interest in gold as a haven.

Gold prices are trading flat while currently testing the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 50, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 2750.00, 2770.00

Support level: 2735.00, 2707.30

The GBP/USD pair is shaping an inverted Head-and-Shoulders pattern at its lowest point in over 10 weeks, indicating a potential trend reversal if it breaks above the 1.3030 resistance level. However, the U.S. dollar remains strong as anticipation builds ahead of next week’s U.S. presidential election. Traders should watch this week’s U.S. GDP and PCE readings, as these economic indicators could further influence the pair’s direction and gauge the strength of the dollar heading into the election period.

GBP/USD remain trading within its bearish trajectory but the bearish momentum is weakening. Should the pair trade above its resistance level at 1.3030, it may be seen as a solid trend reversal signal.

Resistance level: 1.2985, 1.3065

Support level: 1.2910, 1.2850

The EUR/USD pair briefly climbed above its recent high of 1.0826 but then pulled back by approximately 40 pips. If the pair can maintain support above its previous low, this could signal a potential trend reversal. This week, the Eurozone’s GDP and CPI data will be released, which are key indicators for traders to watch closely, as they could significantly impact the pair’s trajectory.

EUR/USD is seemingly easing from its bearish momentum, which may potentially trigger a technical rebound for the pair. The RSI has jumped out from the oversold zone, while the MACD is on the brink of breaking above the zero line, suggesting that the bearish momentum is easing.

Resistance level:1.0815, 1.0890

Support level: 1.0735, 1.0675

Japan’s recent election outcome, which saw Prime Minister Shigeru Ishiba’s coalition lose ground, introduces new challenges to the Bank of Japan’s potential shift toward a hawkish stance. With diminished political backing, Ishiba may struggle to implement more aggressive monetary policies, casting uncertainty over Japan’s economic strategy and likely reducing the BoJ’s capacity to move away from its dovish approach. This scenario is expected to exert downward pressure on the yen, reinforcing a bearish outlook as investors seek currencies backed by stronger rate hike prospects, such as the US dollar.

USD/JPY is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 82, suggesting the pair might enter overbought territory.

Resistance level: 153.25, 154.70

Support level: 151.65, 150.15

The Nasdaq briefly reached a three-month high, buoyed by mega-cap tech stocks, as the 10-year Treasury yield eased, providing favourable market conditions. This week, the tech-heavy index may experience heightened volatility, with heavyweight companies like Microsoft, Meta Platforms, and Amazon scheduled to release their earnings reports. These results are likely to have a direct influence on the Nasdaq’s movement.

Nasdaq is trading in a higher-high price pattern, suggesting a bullish bias for the index. The RSI remains above the 50 level, while the MACD is easing and dropping toward the zero line, suggesting that bullish momentum is easing.

Resistance level: 21075.00, 22040.00

Support level: 19705.00, 19120.00

The Australian dollar remains under pressure against its peers, as recent Chinese economic indicators fell short of market expectations, dampening demand for the Australian dollar, often seen as a proxy for Chinese economic activity. In addition to this, the Australian CPI report is due on Wednesday, with expectations of further easing inflation. If inflation continues to slow, it could place additional downward pressure on the Aussie dollar.

The AUD/USD pair failed to defend itself at the 0.6615 mark, suggesting a bearish signal. The RSI has been flowing below the 50 level, while the MACD edge lower suggests that bearish momentum is gaining.

Resistance level: 0.6615, 0.6675

Support level: 0.6550, 0.6490

Oil prices edged lower following Israel’s recent strike on Iran, which notably spared Tehran’s oil and nuclear facilities, alleviating immediate concerns over energy supply disruptions. The targeted nature of Israel’s strikes on missile factories and other strategic sites outside Iran’s oil infrastructure has raised cautious optimism for a potential de-escalation in the region. Investors should remain attentive to ongoing geopolitical developments, as further escalations or diplomatic efforts could impact oil prices in either direction.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bullish momentum, while RSI is at 36, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 69.90, 70.90

Support level: 67.10, 65.55

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.