PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Hold The Global Markets In Your Hands

Our trading mobile app is compatible with most smart devices. Download the App now and start trading with PU Prime on any device, anytime and anywhere.

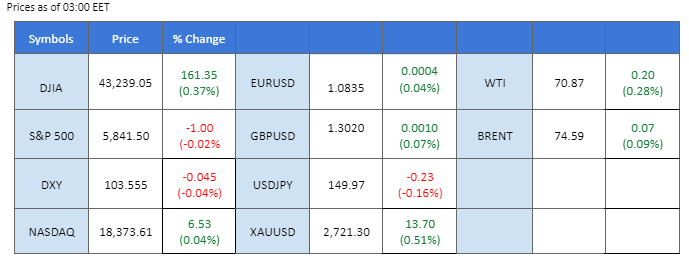

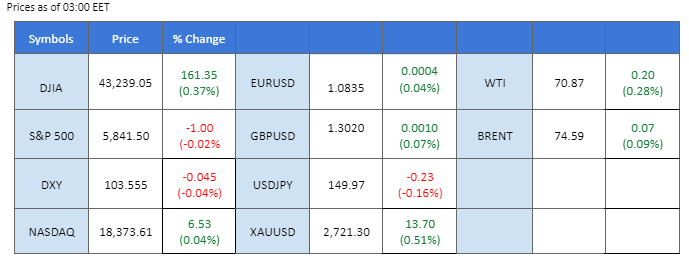

Market Summary

Gold surged to the $2700 mark in the last session as heightened geopolitical risks in the Middle East spurred demand for safe-haven assets. Reports of the Israeli military killing Hamas leader Yahya Sinwar, a key figure behind the attacks that escalated into the Gaza war, have intensified market concerns, driving gold’s upward momentum. In contrast, oil prices remained subdued, further pressured by soft Chinese GDP figures, signalling weaker demand for crude from the world’s second-largest economy.

On the U.S. front, strong economic data, including lower Initial Jobless Claims and better-than-expected Retail Sales, boosted the dollar’s strength against its peers. However, despite this robust data, Wall Street closed lower, as fears of a more hawkish Fed outlook weighed on investor sentiment.

Meanwhile, the Japanese yen rose above the 150 mark against the stronger dollar, with market participants speculating the pair could reach 160 due to uncertainty surrounding the Bank of Japan’s upcoming policy decisions.

The ECB delivered a 25 bps rate cut, in line with market expectations, while a 1.7% CPI reading has led to speculation of a potentially larger rate cut in December.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (7%) VS -25 bps (93%)

(MT4 System Time)

N/A

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index extended its gains, buoyed by strong U.S. economic data that strengthened the outlook for the U.S. economy. Core Retail Sales increased from 0.2% to 0.5%, surpassing expectations of 0.1%. Similarly, the Philadelphia Fed Manufacturing Index posted a much better-than-expected reading of 10.3 (forecast: 4.2). U.S. Initial Jobless Claims were in line with market expectations at 241K. These positive data points led to a rise in U.S. Treasury yields, lowering expectations for aggressive rate cuts by the Federal Reserve.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the index might enter overbought territory.

Resistance level: 103.95, 104.95

Support level: 103.25, 102.50

Gold prices continued to climb as rising tensions in the Middle East spurred safe-haven buying. The death of Hamas leader Yahya Sinwar, a key figure in the October 7 attack, has intensified geopolitical concerns, further supporting gold prices. The market remains focused on the conflict, driving investors toward gold, although gains are still capped by a stronger U.S. dollar amid recent positive economic data.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 72, suggesting the commodity might enter overbought territory.

Resistance level: 2705.00, 2725.00

Support level: 2690.00, 2670.00

The GBP/USD pair has extended its decline to a 2-month low, driven by the softer-than-expected UK CPI reading and robust U.S. economic indicators, which bolstered the U.S. dollar. However, the bearish momentum appears to be easing. If the pair manages to break above the 1.3040 level, it could signal a potential trend reversal. Today’s U.K. retail sales report is a key focus for traders, as it may provide the catalyst for a technical rebound, depending on the strength of the data.

GBP/USD dipped lower, but the losses were quickly recovered in the recent session, suggesting a potential trend reversal for the pair. The RSI remains below the 50 level, while the MACD is on the brink of breaking above the zero line, suggesting that the bearish momentum is easing.

Resistance level: 1.3060, 1.3140

Support level: 1.2980, 1.2910

The EUR/USD pair has been sliding for the past four sessions, hitting a 10-week low, signalling a bearish bias for the euro. The recent ECB interest rate decision, which included a 25 bps rate cut, aligned with market expectations but did little to support the currency. Adding to the euro’s weakness, the eurozone CPI reading came in below market forecasts, reinforcing speculation that the ECB may deliver a larger rate cut by the end of 2024. This dovish outlook has further weighed on the euro, contributing to the pair’s continued decline.

EUR/USD has declined to its 10-week low, suggesting a bearish bias for the pair. The RSI has entered the oversold zone, while the MACD is edging lower, suggesting the pair remains trading with strong bearish momentum.

Resistance level: 1.0890, 1.0950

Support level: 1.0805, 1.0740

Rising U.S. Treasury yields have kept the U.S. equity market in a wait-and-see mode. Despite macroeconomic pressures, several companies posted better-than-expected financial results, offering support to the market. The S&P 500 and Nasdaq 100 remained mostly unchanged, while the Dow Jones Industrial Average gained 0.4%. Nvidia Corp. rose after an optimistic forecast from Taiwan Semiconductor Manufacturing Co. Meanwhile, Travelers Cos. increased by 9% following a profit jump to $1.3 billion. On the downside, Elevance Health Inc. fell 11% after cutting its annual forecast. Netflix Inc. rallied after beating subscriber growth estimates.

Dow Jones is trading higher while currently testing the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the index might enter overbought territory.

Resistance level: 43440.00, 44900.00

Support level: 42420.00, 41400.00

The USD/JPY pair has broken above the critical 150.00 level, signalling strong bullish momentum and a continued weakening of the Japanese yen. This movement is primarily driven by the strengthening U.S. dollar and the recent soft CPI reading released during Friday’s Tokyo session, which further weakened the yen. BoJ watchers are predicting the pair could reach the 160 mark if Japan’s economic indicators continue to show weakness. The prospect of further yen depreciation remains high, especially with ongoing concerns over Japan’s economic performance and monetary policy stagnation.

The pair remains in an uptrend, suggesting a bullish bias. The RSI has been hovering above the 50 level, while the MACD remains above the zero line, suggesting the pair remains trading with bullish momentum.

Resistance level: 150.85, 152.25

Support level: 147.30, 145.85

Ethereum (ETH) is currently attempting to break above its long-term downtrend channel, with support near the $2600 mark, indicating a bullish bias for the cryptocurrency. The consistent inflows into ETH ETFs in recent sessions, coupled with increased staking activity, are providing additional support to ETH’s upward momentum. These factors could help propel ETH prices higher, as both institutional and retail interest in the asset continues to grow. A successful break above this resistance level may serve as a strong bullish signal for further gains in the near term.

ETH is currently trading at the junction to break its bearish structure. A break above the $2700 mark would be a long-term trend reversal signal for ETH. The RSI is hovering close to the overbought zone, while the MACD is above the zero line, suggesting ETH is trading with bullish momentum.

Resistance level: 2700.00, 2865.00

Support level: 2480.00, 2350.00

Crude oil futures edged higher on Friday, underpinned by a surprise drop in U.S. oil inventories and ongoing tensions in the Middle East. Despite these factors, crude prices are set for their largest weekly decline in over a month. Data from the Energy Information Administration (EIA) showed U.S. crude oil, gasoline, and distillate inventories all dropped last week. However, concerns over weakening demand, following reduced forecasts from OPEC and the International Energy Agency, dragged Brent and WTI down about 6% this week.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bullish momentum, while RSI is at 37, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 72.55, 74.75

Support level: 69.85, 67.10

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.